Katalyst.Ventures, a new firm led by Susan Choe, has raised $34 million

There aren’t a lot of venture funds that are led by a single general partner who happens to be a woman. Sonja Hoel Perkins is one. The longtime Menlo Ventures managing director founded her own venture firm two years ago.

Cindy Padnos, who spent four years with Outlook Ventures as a director before founding her own firm, Illuminate Ventures, nine years ago, is another.

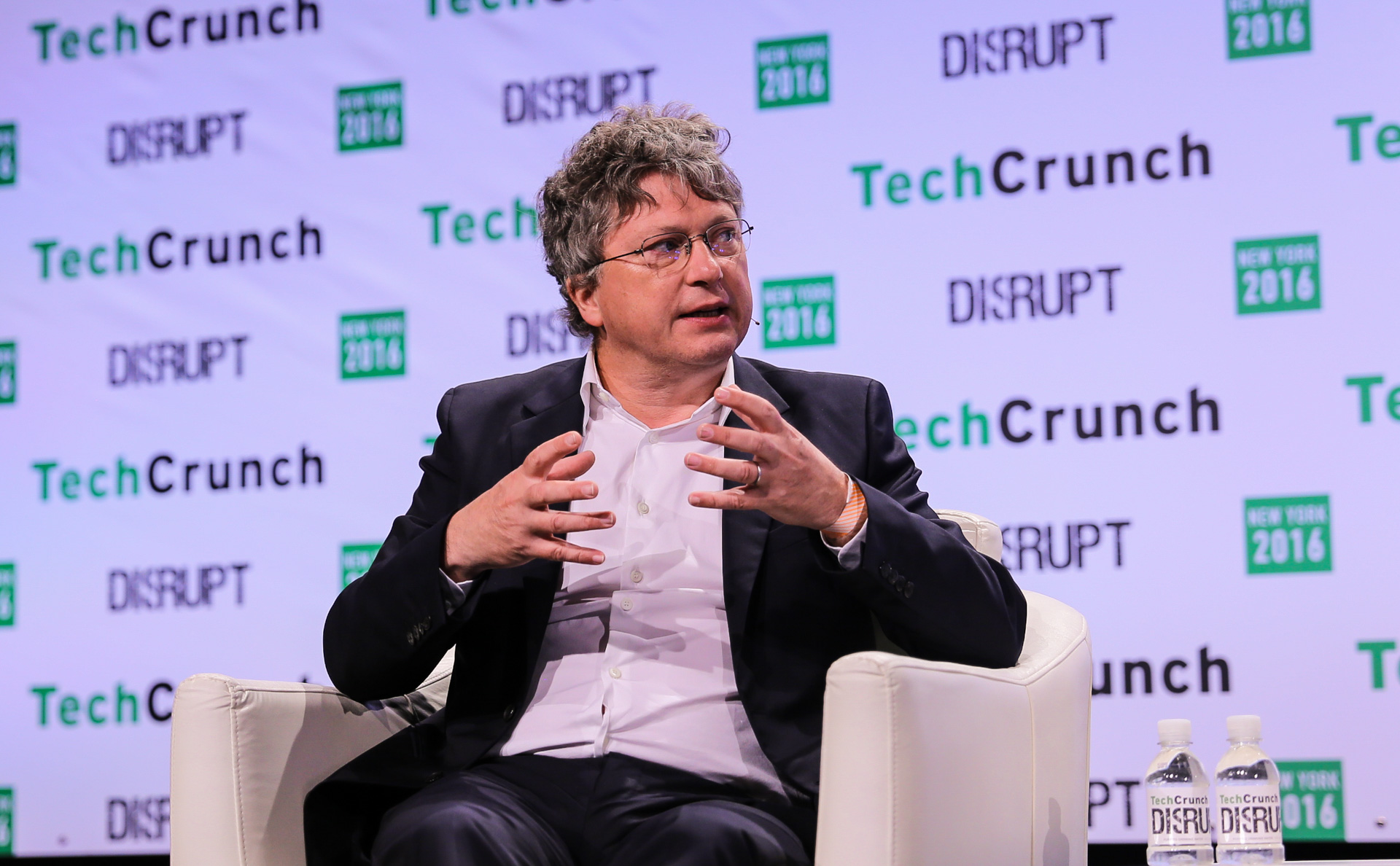

Now Silicon Valley has a new entrant on the micro VC scene. Susan Choe, a longtime investor who previously cofounded four-year-old Visionnaire Ventures, has raised at least $34 million for the debut fund of her firm, Katalyst.Ventures, according to a new SEC filing.

The filing states that Katalyst has secured the capital commitments from just four investors. Katalyst’s website suggests the firm’s focus is primarily on nascent artificial intelligence startups and teams.

Choe had previously founded a gaming company called Outspark that was sold to Axl Springer for undisclosed terms. (She sat down with investor Jason Calcanis to talk about her startup back in 2010 if you’re curious to learn more.)

Choe is also still listed as a managing director on the website of Visionnaire, though the firm appears not to be actively investing. At least, Visionnaire itself began targeting a $250 million second fund in 2016, according to an SEC filing, and it never announced a close on that fund.

Meanwhile, as with Choe, a second managing director, Keith Nilsson, who was formerly a former partner with TPG Growth, appears to have another gig. Though he is listed as a managing director with Visionnaire at its site, he also states on LinkedIn that he is a managing partner of seven-year-old Xplorer Capital.

Visionnaire’s chairman, Japanese billionaire Taizo Son, brother to SoftBank’s Masayoshi Son, also recently moved from Tokyo to Singpore where he now heads up Mistletoe, a venture capital firm that’s part accelerator and part incubator. He talked with CNBC last fall about the move.

Visionnaire’s investments include JoyRun, a 3.5-year-old,Santa Clara, Ca.-based peer-to-peer food and drinks delivery app that enables users to learn who, nearby, is already heading out to a restaurant that they like, then tack on an order of their own. (It raised $10 million in Series A and seed funding roughly a year ago.)

Another of its most recent investments, made in late 2016, includes Helpshift, a now six-year-old, San Francisco-based mobile customer service platform for businesses that has raised roughly $38 million, according to Crunchbase.

We’ll have to wait and see what types of deals Katalyst targets, but undoubtedly a new fund led by an operator and investor who is also a woman will be welcome news to many in Silicon Valley.

New firms generally have far greater female partner representation than at traditional venture firms. In the last three years, according to recent Crunchbase data, 21 percent of newly launched venture and micro-venture firms had at least one female at the helm.

Featured Image: Lacy Atkins/THE CHRONICLE

Published at Sat, 20 Jan 2018 19:59:31 +0000