Cardlytics filed for marketing analytics IPO

Cardlytics has been on file for IPO, multiple sources tell TechCrunch. The Atlanta-based marketing analytics business filed its confidential S-1 last year and has been trying to determine the best time to go public.

One source with knowledge of the business says that part of the delay is related to potential partnerships that would put the company in a better position for a market debut, likely next year. We’re hearing that Cardlytics has also entertained informal acquisition conversations in the past.

Last year, the company shed almost 15% of its workforce in a move that was said to improve its financials ahead of a potential IPO.

When asked about IPO possibilities, a spokesperson for Cardlytics said the company doesn’t comment on “rumors or speculation.”

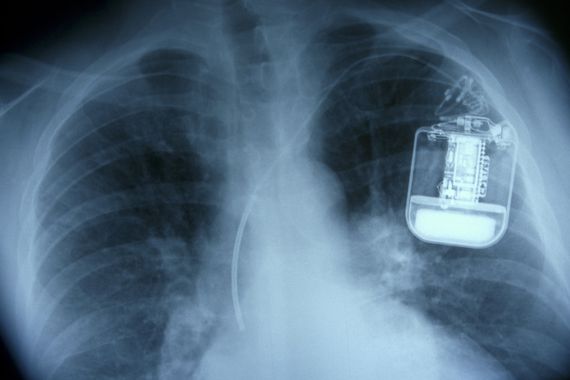

Cardlytics works with financial institutions like Bank of America to run customer loyalty and banking rewards programs. Through this, it gets a glimpse at what customers are buying and shares these insights with marketers.

The business has raised almost $200 million in equity financing from Discovery Capital, Canaan Partners, Atlanta Ventures and others, dating back to 2009.

Completing the IPO filing is a key hurdle in the process. The documents, often hundreds of pages long, share everything from a company’s financials to its goals to potential business risks. Companies work together with lawyers to make sure that all SEC requirements are met.

Since a JOBS Act provision in 2012, companies have been able to do what’s known as a “confidential filing.” Businesses can continue to make revisions behind closed doors, without public scrutiny.

While the confidential filings were designed to make it easier to go public, it also makes it easier to postpone IPOs because there’s less external pressure. It’s not uncommon for a company to remain on file for a year or more.

This year was widely expected to see more tech IPOs. Favorable market conditions mean the “window is open,” but it’s still been a below average year.

Some venture-backed businesses are waiting longer, in an attempt to improve financials and avoid what’s become known as a “down round IPO,” where the public market value of the company is lower than the private valuation.

Featured Image: Rafe Swan/Getty Images

Published at Mon, 30 Oct 2017 07:45:40 +0000