Is AR eyewear ready for consumers? Are consumers ready for AR eyewear?

Augmented reality marked a major milestone this year. For the first time two technology titans revealed their intentions to bring AR to the mass consumer market — via mobile devices. Apple announced the release of its new ARKit in June, soon followed by the debut of Google’s ARCore in August, and their respective developers immediately set to work creating new consumer-oriented AR games and apps.

It’s too early to know what the new ecosystem of software and hardware designed to provide AR experiences will evolve into in the future, but it’s safe to predict that AR headsets will be part of the picture. So why is AR suddenly ready for mass consumption? And why aren’t we leaping (magically!) into AR glasses?

The answers are simple enough: Technology takes time to develop, and users need time to adapt.With any disruptive technology, the classic adoption curve usually holds true: innovators first, followed by early adopters, early majority, late majority and, finally, laggards … your grandma.

On the development trajectory, Snap Filters and Pokémon GO warmed up the consumer market, in small stages, for a more robust AR experience on their mobile devices. And the mobile device is paving the way for the next milestone in the development of AR: headsets. We can expect consumers to follow the typical adoption curve with AR headsets, just as they would for any new technology. Still, before AR eyeglasses are ready to go mainstream, manufacturers have a few hurdles to clear, including cost, form, function and content.

For mass-market adoption, AR glasses will need to be priced comfortably under $1,000; early adopters are likely to opt for a pair of high-functioning glasses if they cost about the same as a high-end phone ($700 to $900).

In a few years, after several cycles of innovation and applications of Moore’s Law, carriers might well subsidize AR glasses, or at least sell them at wholesale prices, which would significantly drop prices, reduce the perceived risk and lead to increased sales among early majority and late majority consumers. Carriers could potentially benefit from much higher billable network usage, as heavy processing-powered apps coupled with entertainment consumption are likely to dwarf most consumers’ phone data usage. What’s more, the mass-scale adoption of AR glasses itself will drive prices down as the production costs scale.

The ultimate AR user experience and loyalty to one AR system will depend on offering users the ideal UI for navigating the new AR ecosystem.

As for form, many optic solutions for AR today are bulky and heavy. While it may be true that early adopters or tech enthusiasts are willing to sacrifice good looks if they’ll gain hero-level functionality, the majority of users would like their “wearables” to be just that — wearable.

The size and weight of the glasses will be important to consumers, and because optical technology has a major impact on size and weight, it’s a critical component in the form factor that smart glass manufacturers need to master. The most advanced optics enable manufacturers to produce small, sleek eyeglasses and keep them small and light, with the potential to deliver far more versatile functionality.

Achieving the right form factor will also require manufacturers to consider the configuration of the glasses. Will AR glasses be a standalone product, or will they require an external control box to house power sources and processors? Will consumers wear smart glasses that are tethered to their phones or a control box? They might if the glasses themselves look geek-chic and offer enormous value to wearers. Beats provides a good example of bucking the trend, with its oversized, tethered headphones that succeeded wildly in the age of ear buds and Bluetooth.

The key issues of battery life and efficiency could become a roadblock to developing optimum functionality. Currently, there’s a surge in investments for companies in this space, like Microvast and Gridtential Energy, two companies reinventing the traditional battery chemistry. We can expect innovative battery companies like these to have a great impact on the AR industry, not least by providing a more efficient battery to power AR glasses.

Processors running hot are an obstacle to achieving peak functionality, as well. Much of the essential functionality of AR glasses, from tracking a user’s environment and movements to generating geographically accurate contextual overlaid content, results in over-heated processors. Dissipating that heat is a challenge many AR glasses manufacturers with head-worn processors have yet to solve.

Developing the right user interface is another vital step toward making headsets mainstream. With ARKit, ARCore and Facebook’s AR Studio paving the way for developers to build AR-enabled apps, expect to see content creation explode over the next 12-18 months. The ultimate AR user experience and loyalty to one AR system will depend on offering users the ideal UI for navigating the new AR ecosystem.

These challenges are formidable, but manufacturers in the AR industry have the resources and motivation to face them head-on. What’s at stake is nothing less than the next great transformative experience in technology, and what manufacturer wouldn’t want to be there when history is made?

With that in mind, we wouldn’t be surprised to see consumers — the innovators and early adopters, that is — wearing AR glasses within the next two years.

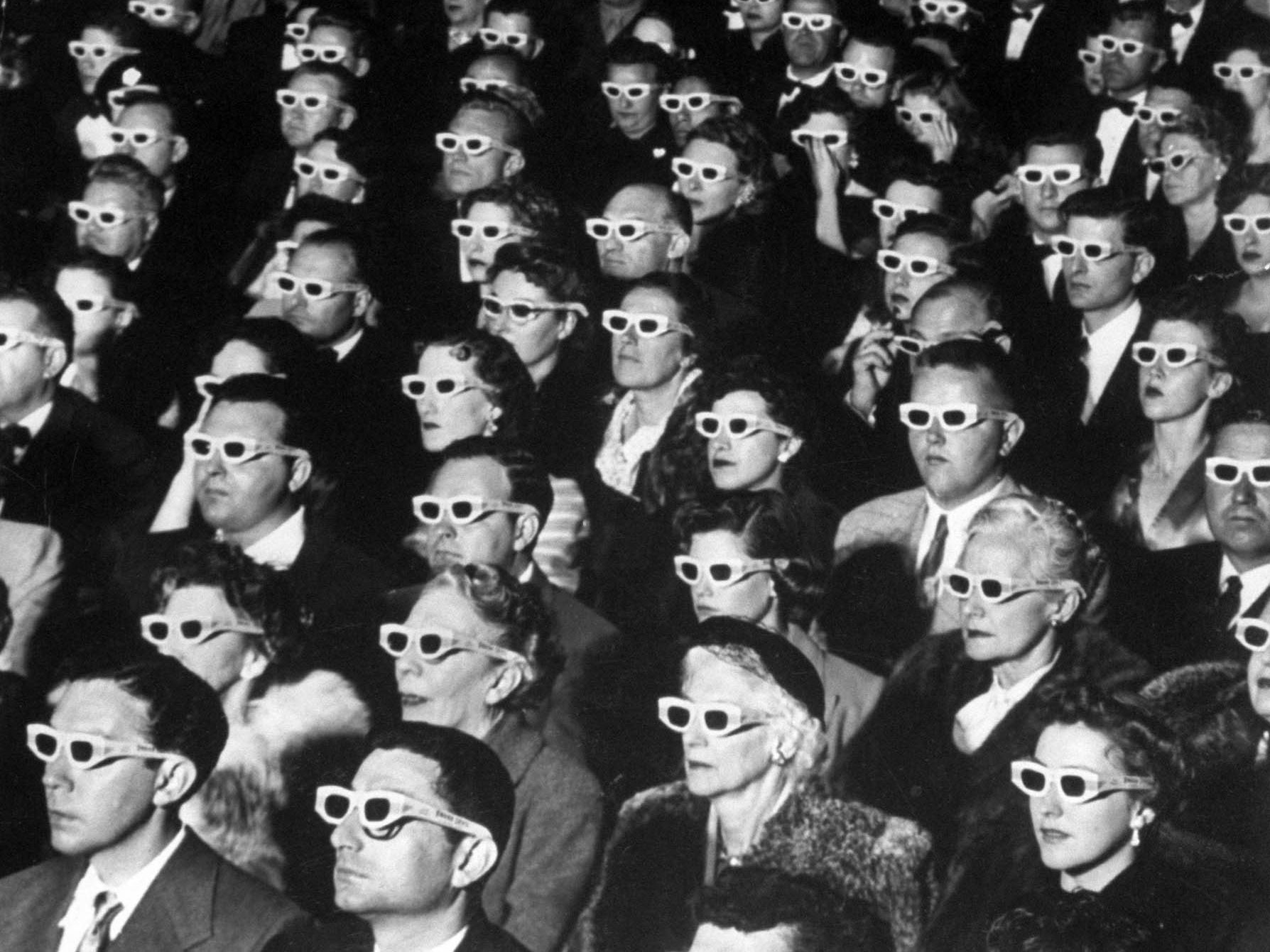

Featured Image: J. R. EYERMAN/TimePix/Getty Images

Published at Sat, 28 Oct 2017 20:00:23 +0000