Broadcom confirmed this morning that it would offer to acquire Qualcomm in one of the largest tech deals of all time, and one that would consolidate two storied semiconductor companies into a single unit as the chip world has begun a course shift in the past year. But it’s as much a story of a potential consolidation of fabless semiconductor giants as it is one of the performances of two companies — one that has done quite well, and one that has been emphatically ho-hum.

As Qualcomm finds itself embroiled in a massive legal battle with Apple, one that could potentially escalate to the hardware level in which Apple extricates Qualcomm from its future devices, it’s seen its stock face a steep decline — and then a massive jump following the news of the Broadcom deal. Meanwhile, Broadcom under CEO Hock Tan has seen its stock methodically climb over the past two years, seeing its market cap double.

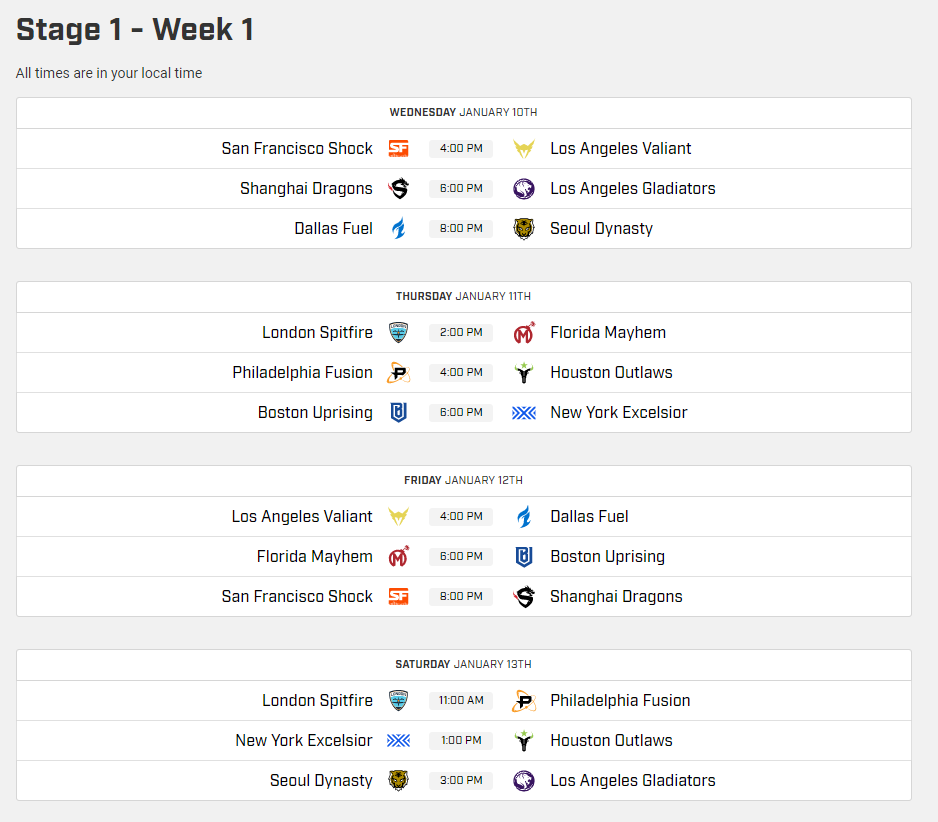

Here are the charts that show the stocks from the past two years. Qualcomm’s is up nearly 20 percent, but that’s following the announcement of the deal with Broadcom:

Meanwhile, Broadcom has seen its stock more than double in the past year:

Qualcomm also has seen some decline in revenue, both in this most recent quarter and also for the fiscal year of 2017. Here’s a quick rundown of each company’s revenue, including its past life as Avago Technologies:

Qualcomm’s patent portfolio is a point of strength for the company and the major source of tension in its spat with Apple and the continuing string of legal battles between the two. Here’s a quote from Apple CEO Tim Cook from an early call to discuss its second-quarter performance with investors regarding the legal battle:

“The reason that we’re pursuing this is that Qualcomm‘s trying to charge Apple a percentage of the total iPhone value, and they do some really great work around standards-essential patents, but it’s one small part of what an iPhone is,” Apple CEO Tim Cook said on the company’s second-quarter earnings call earlier this year. “It’s not — it has nothing to do with the display or the Touch ID or a gazillion other innovations that Apple has done. And so we don’t think that’s right. And so we’re taking a principled stand on it, and we strongly believe we’re in the right. And I’m sure they believe that they are, and that’s what courts are for. And we’ll let it go with that.”

Qualcomm said in its fourth-quarter release, which detailed its fiscal 2017 performance, that its net income fell 57 percent, to $2.5 billion in fiscal 2017 from $5.7 billion in fiscal 2016. Its diluted earnings per share, another critical metric for Wall Street, also fell 57 percent. In short, in the past year, Qualcomm has seen its earnings slip away even though it retains a leading position in the chip market.

It’s a very aggressive move for Broadcom and Tan, who while retaining dominance in the chip market are also facing a future where there’s a new story in silicon: AI-heavy devices powered by GPUs, which specialize in the calculations required to handle processes like speech and image recognition. Nvidia has become a clear leader in this space, seeing a massive run-up as more and more car makers look to create some form of autonomous driving and companies explore building their own chip technology that can power their AI processes, like Apple and Google.

Still, acquiring Qualcomm would consolidate those patents and Qualcomm’s position as the next generation of wireless networks begins to play out and millions of internet-connected devices come online in the next several years. Should it come to pass that Apple exiles Qualcomm, the combined companies seem to be in a position to trim anything unnecessary and focus on where they perform best — or make aggressive moves into new areas.

Featured Image: Dragon Images/Shutterstock

Published at Mon, 06 Nov 2017 19:05:11 +0000